- Green tech investment within the United States soared from $228 million in 2005 to $1.57 billion in 2007, up more than 586 percent over the three years, according to Cleantech Group, a research and financial services firm.

- The trend is continuing at a rapid clip this year, with $2.8 billion invested in the first nine months, reports Cleantech Group.

- Clean energy investment is accounting for an ever larger share of the total U.S. venture capital "pie," says Mark Heesen, president of the National Venture Capital Association. He estimates that clean energy investment will account for 15 percent of the total U.S. venture capital pie, compared to 11 percent last year and less than 4 percent in 2006. His figures include both green tech and "brown tech," which which seeks to use fossil fuels more cleanly and efficiently.

- The financial turmoil on Wall Street and the credit crunch is not likely to significantly slow venture capital's rush into green tech, says David Prend, a partner with RockPort Capital Partners. "We're fairly comfortable we're pretty well insulated from the turmoil in the markets. We have a long horizon. We're private money, and we don't use much debt," Prend says. RockPort Capital, which has $800 million under management, specializes in green tech venture financing. Still, there are signs some venture capital is drying up. For example, Tesla Motors, the electric carmaker, recently announced it's cutting staff and postponing new models because venture capital funding has dropped.

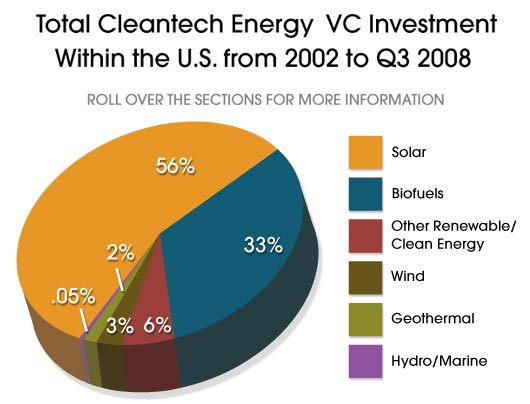

- Many venture capital firms have been quickly shifting their focus from one technology to another. Ethanol and other biofuels, for example, were the rage in 2006 as oil prices shot up and federal and state laws favored them. But they're no longer attracting big venture capital dollars. The biofuels didn't live up to their promise as a less expensive alternative to gas because of the high cost to make and transport them.

- Two of the hottest green tech areas of late have been what's called thin-film solar and solar thermal. Thin-film solar refers to cost-saving processes that make photovoltaic solar cells -- the kind on rooftops -- in thin sheets. And a growing number of utilities in the sun-blessed Southwest employ solar thermal, which uses mirrors or lenses to concentrate sunlight and produce steam for generating electricity.

- A big spur to the development of solar technology is government guarantees by several European countries that utilities must pay a generous rate to individual solar producers who sell into the countries' electricity grids. The prospect of a booming European market for solar equipment is inspiring venture funding of related technology.

- Another big boost to green tech was approval of a federal solar power subsidy as part of the financial bailout package passed by Congress in October 2008. The law provides a 30 percent tax credit for solar energy investment through 2016. Ensuring that the tax credit will remain in place for eight years is "the single biggest thing for the [solar power] industry that the government has ever done," says Daniel Kammen, a professor specializing in renewable research at the University of California, Berkeley.

Readings and Links

Views on a Radically Changed World

Will the world be able to act in time and dramatically cut the carbon emissions responsible for wreaking havoc on the planet's climate? Analysis from FRONTLINE's experts.

Capitalism to the Rescue

New York Times magazine cover story on the V.C.s at Kleiner Perkins, who, in helping tackle climate change, may be able to make a lot of money at the same time (October 2008)

Green Energy is the Modern Gold Rush

"Alternative power investors are falling over themselves to put cash into the search for cleaner fuels." (The Guardian, July 2, 2008)

Environmental Capital

Daily analysis of the business of the environment by The Wall Street Journal.

PricewaterhouseCoopers Q3 2008 "MoneyTree" Report (PDF)

An overview of accounting firm PWC's third quarter report on venture capital funding as a whole.